|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

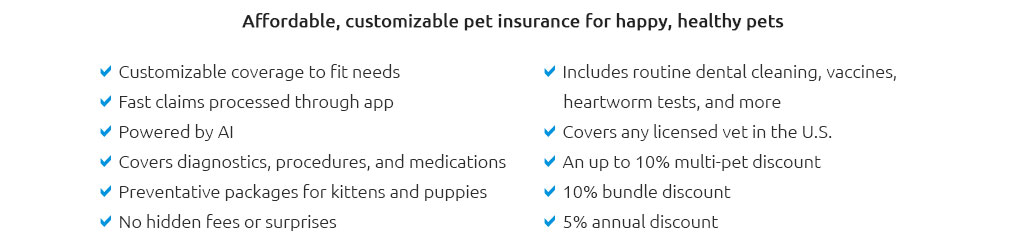

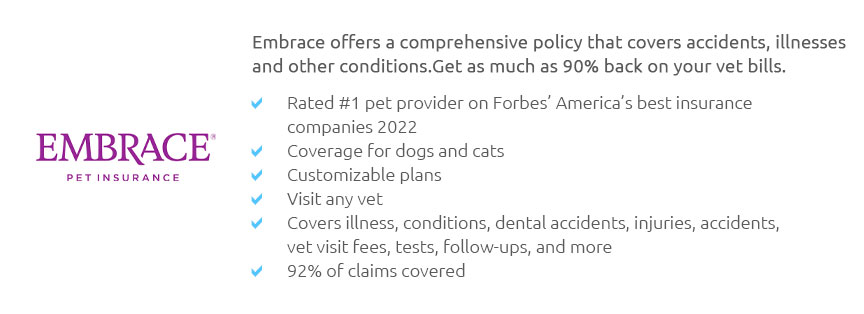

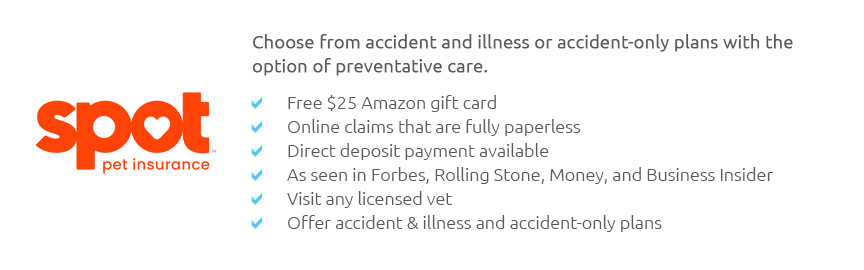

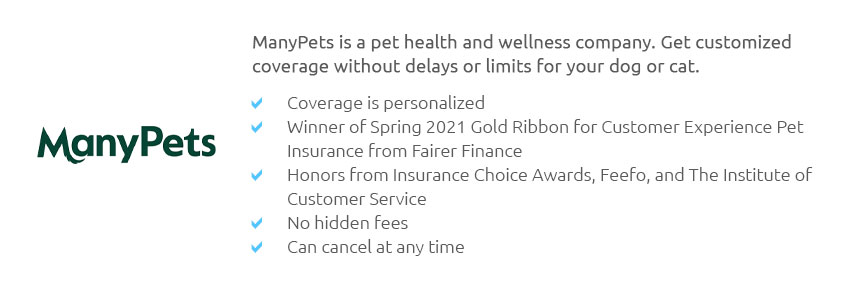

Understanding Pet Insurance: A Closer Look at Policies Covering Vet VisitsIn today's ever-evolving world, the importance of comprehensive pet insurance cannot be overstated. As the bond between humans and their furry companions deepens, more pet owners are recognizing the value of having a financial safety net that extends beyond the basics, particularly one that encompasses routine veterinary visits. This article delves into the intricacies of pet insurance policies that cover vet visits, exploring their mechanisms, benefits, and potential drawbacks while offering a balanced perspective for those considering this option. Pet insurance is designed to mitigate the often unpredictable costs associated with veterinary care. While many policies traditionally focus on covering catastrophic events, such as accidents or illnesses, there is a growing trend towards offering coverage for regular vet visits. This shift is driven by an increased awareness of preventive care's role in enhancing a pet's quality of life and potentially extending their lifespan. But how exactly does this type of insurance work? At its core, a pet insurance policy that includes vet visit coverage operates on a reimbursement model. Pet owners typically pay a monthly premium, which grants them access to a predefined set of benefits. When a visit to the vet occurs, the pet owner initially covers the cost out-of-pocket. Subsequently, they submit a claim to the insurance provider, who then reimburses a percentage of the expenses, as per the terms outlined in the policy. This reimbursement can vary significantly, with some policies covering up to 90% of costs, while others might offer lower percentages. The Benefits of including vet visits in a pet insurance plan are manifold. Primarily, it promotes regular check-ups and vaccinations, which are crucial in detecting potential health issues before they escalate into serious problems. By alleviating the financial burden, owners are more likely to adhere to recommended veterinary schedules, ensuring their pets receive timely and appropriate care. Furthermore, this proactive approach often translates into cost savings in the long run, as preventing disease is invariably less expensive than treating it. However, it's not all sunshine and rainbows. Critics argue that the inclusion of routine care can drive up premium costs, making insurance less accessible to those on tighter budgets. Additionally, not all policies are created equal; the extent of coverage for vet visits can vary widely between providers, necessitating careful comparison and scrutiny of policy details. Prospective buyers should be vigilant in examining factors such as coverage limits, exclusions, and waiting periods to ensure they select a plan that aligns with their financial situation and their pet's specific needs. Another crucial aspect to consider is the network of veterinarians associated with the insurance provider. Some policies may restrict coverage to a specific group of vets, which could be limiting for pet owners in certain geographical locations or those with established veterinary relationships. Therefore, it is prudent to verify whether your preferred veterinarian is included in the plan's network before making a commitment. In Conclusion, while pet insurance that covers vet visits offers numerous advantages, it is not a one-size-fits-all solution. It requires thoughtful consideration of one's financial capabilities, pet's health needs, and personal preferences. By weighing the benefits against potential downsides and carefully reviewing policy details, pet owners can make informed decisions that best serve their beloved companions' well-being. As the landscape of pet insurance continues to evolve, staying informed and proactive will be key to maximizing the value derived from such coverage. https://www.cnbc.com/select/best-wellness-pet-insurance/

CarePlus by Chewy Pet Insurance - Policy highlights. CarePlus offers accident-only, accident and illness and wellness plans through Lemonade and Trupanion. - Age ... https://www.aspcapetinsurance.com/research-and-compare/pet-insurance-basics/whats-covered/

Not all pet insurance providers cover exam fees for eligible conditions, which are part of almost every veterinary bill. That coverage is built into our plans. https://www.trupanion.com/

Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote!

|